Proficient Institutional Desk

An institutional trading desk is a desk where transactions for buying and selling securities occur on behalf of organizations (banks, institutions, etc.) involved in trading investment instruments such as equities, futures, commodities and currencies. We are open to offer solutions to individuals, corporates as well as institutions.

Single point service

Long-term wealth accumulation

Block deal executions

Multi strategy execution

Inclusive FPI services

Enhance the value of your investment with us

Our

Offerings

- Choice of various schemes from all major fund houses

- Online and offline transaction facility

- Web Based Online Client Back Office

- Low Transaction Costs

- Monthly MF insights

Benefits of Mutual Funds through us

- Fund Managers to take care of your investments.

- Information and guidance to select the right scheme

- Superior trading platform for multi exchange MF

- Unbiased advice backed by in-depth research

- Dedicated Customer Helpdesk

Eligible Securities for FPIs

Equity

- Listed equity shares, partly paid equity shares

- Preference shares

- Warrants

- Initial Public Offerings (IPO)

- Mutual Funds and ETF

Derivatives

- Equities

- Currency

- Interest Rate

Debt

- Bonds

- Non-convertible debentures

- Government securities

Alternate Investments

- Alternative Investment Funds (Category III AIF)

- Real Estate Investment Trusts (REIT)

- Infrastructure Investment Trusts (InvIT)

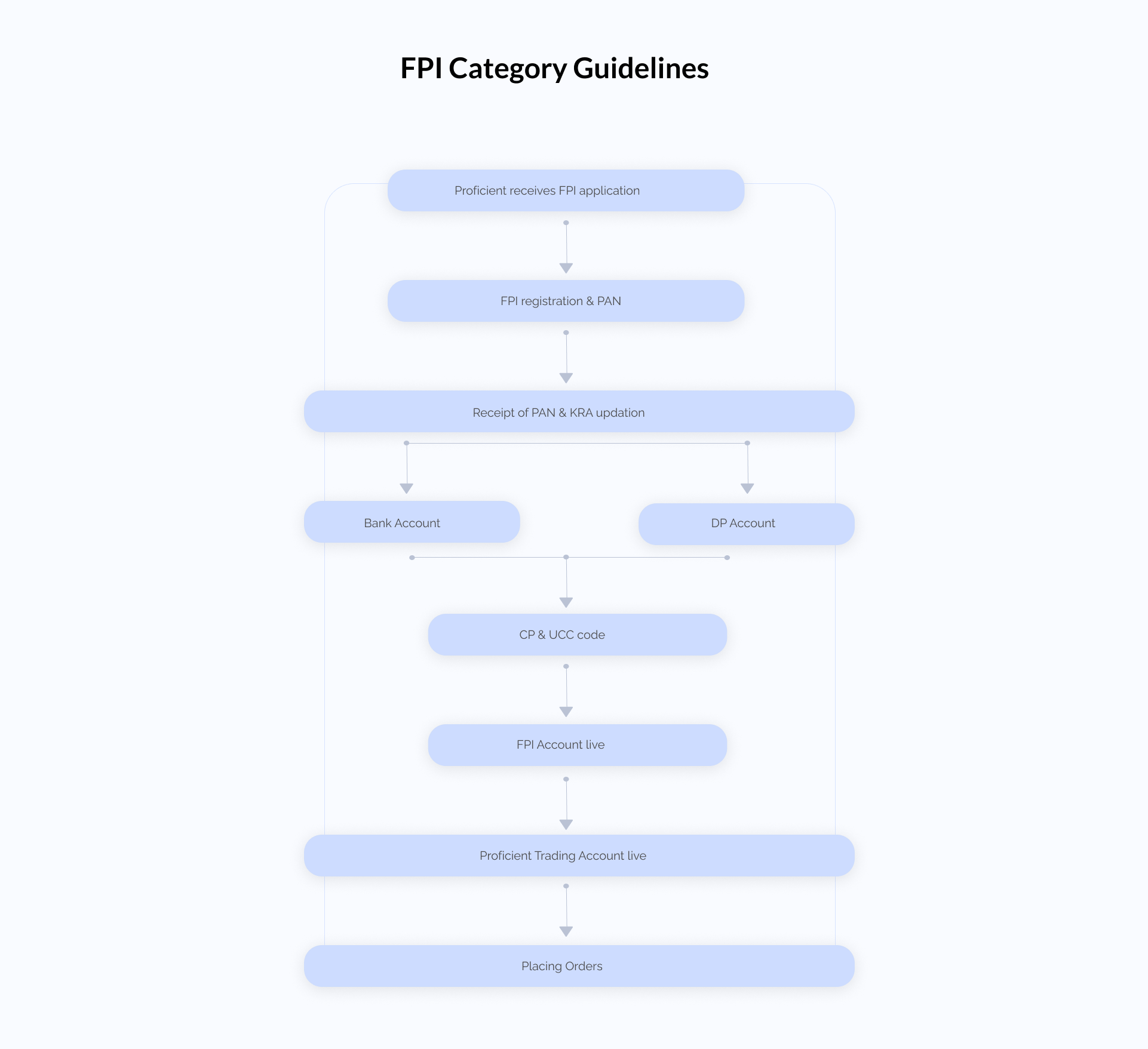

FPI Category Guidelines

Any applicant seeking registration as a foreign portfolio investor may apply in one of the categories as per the revised operational guidelines issued by SEBI in 2019

Category 1

- – Government/ government related investors like centralized banks or sovereign wealth funds.

- – Pension funds and university funds.

- – Appropriately regulated funds / entities such as banks, mutual funds, insurance companies, portfolio managers etc.

- – Entities / establishments from FATF member countries.

- – Unregulated funds where investment manager is from FATF countries.

SEBI fees: $3,000

Category 2

- – Regulated Funds that cannot be registered as Category I FPI

- – Charitable organizations

- – Family offices and Trusts

- – Individuals (other than NRI / OCI /RI)

- – Funds from non-FATF member countries

- – Endowments and foundations

- – Entities considered appropriate as per SEBI guidelines.

SEBI fees: $300

Contact us

Have an inquiry? We’ll be happy to assist you

033-40266326

23, R.N Mukherjee Road, BNCCI House, 4th Floor,

Kolkata-700001