There are a number of ways in which investors can shield their portfolios from interest rate risk, many of which involve simple yet effective fixed-income strategies. Bond investors may face credit risk, call risk, inflation risk, and interest risk when they invest without strategies. Interest rate risk is of important note because even though an investor may think that they are benefiting from a fixed rate and steady payment for a given duration, the volatility of the market and interest rates could make potential investments less valuable than other alternatives. Using a bond investment strategy can help reduce risk or maximize profit from an investment.

What is Barbell Strategy?

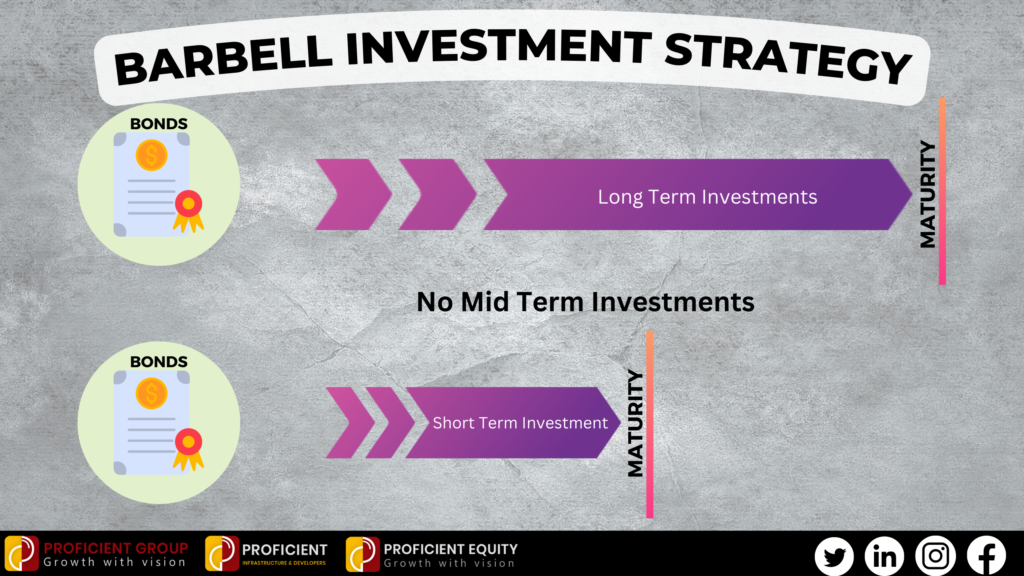

The barbell strategy pairs high-risk, high-return bonds with low-risk, low-return bonds and invests nothing in the middle-risk options. This balances the risk of volatile interest rates for the investor and can be used for both fixed-income investing and equity markets. Longer dated bonds usually offer higher interest yields, while short-term bonds provide more flexibility.

Short-term bonds give an investor the liquidity to adjust potential investments every few months or years. If interest rates start to go up, the shorter maturities allow an investor to reinvest in bonds that will give higher returns than if that money was tied up in a long-term bond.

The long-term bonds give an investor a steady flow of higher-yield income until maturity. However, by not having all of your funds in long-term bonds, this limits the downside consequences if interest rates were to rise in that bond’s span.

Barbell investing strategy

What is Bullet Strategy?

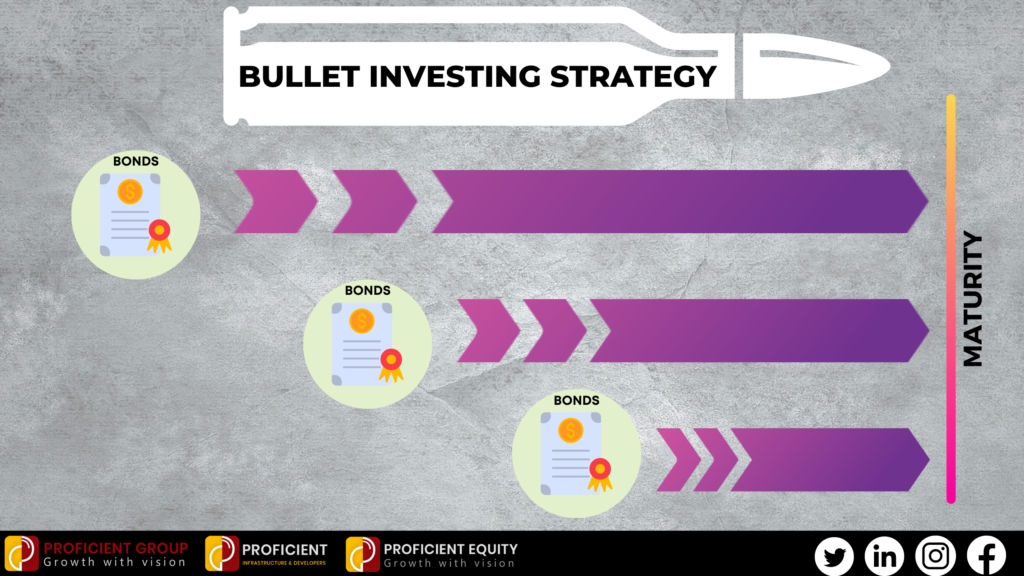

The idea in this strategy is to buy bonds at different points in the same time scope which mature all at the same time. For example, you invest in a bond which matures in 20 years. Then 5 years later you buy a bond which matures in 15 years. Then again, you invest in a bond 5 years later which matures in 10 years. After the maturity period of all the bonds you can restart the strategy with new investments for a new time period.

By staggering the purchase of bonds, investors can more efficiently seek out investing options that have more attractive interest rates. Since all of the bonds have the same maturity date, investors are able to receive potentially more attractive inflow. However, because the investor is staggering the purchase of the bonds, it can lead to a risk that interest rates may fall over the bond purchasing period. Keeping a close eye on the interest rates is the key to successfully executing this strategy.

Bullet Investing Strategy

Barbell Vs Bullet Strategy

- Barbell strategy gives good diversification, high liquidity, and higher yields than with a bullet strategy.

- Risks of a barbell strategy include the volatility of long-term bonds and a lack of mid-term bonds, especially during uncertain economic cycles.

- If one has a need for a certain amount of money after a certain period of time, they can go for a bullet strategy. Whereas, if one wants to earn high returns and diversify their investment style they can opt for barbell strategy.

Conclusion

Both the bond investment strategies take time and effort to see the potential benefits, but if an investor is willing to put up with the work and has patience to see long-term gains, then these strategies can be favorable. At the end, it comes to the investors psychology and requirements which decides which strategy they might adopt. One might apply different strategies throughout their lifetime for learning different investing opportunities.

DISCLAIMER – This is for educational purposes only. We do not give investing suggestions nor are we responsible for any profits and losses. Investing is subjected to market risks. Please consult professionals before investing.